At first glance, the recent Federal Budget appears to neglect the urgent concerns of the road transport industry, signalling instead a surge in operational costs. This rise comes in the form of a 19% increase in the heavy vehicle road user charge rate, growing from 27.2 cents to 32.4 cents per litre by the fiscal year 2025-26 (a six percent increase each year for the next three years) The raised funds are earmarked for road maintenance and repair initiatives. This development is distressing for an industry grappling with immense pressure, matched only by sectors like construction and hospitality. Restructuring and insolvency expert, Jason Preston was quoted in a recent article in The Age and he highlighted the transport and logistics industry is struggling under the burden of rising costs. Preston expressed concerns regarding overcapacity in certain areas and the battle to sustain profitable margins.

Unfortunately, the sector’s challenges go beyond rising costs alone. This article takes a closer look at some of the key challenges and opportunities to fuel the sector into the future.

Skills Shortage

The shortage of skilled drivers is a significant challenge and one that requires a long-term, collaborative approach by the government and industry. Attracting new people to the industry is vital and embracing workforce diversity is part of this solution. The updated immigration estimates for the coming years may be an opportunity for the industry, but only if can position itself as an attractive workplace.

Driver Safety & Education

Influencing both the appeal of the sector and the long-term survival of businesses, the industry, along with its supporting bodies have established safer operational practices and made significant progress, with initiatives including the Chain of Responsibility laws and the incorporation of innovative safety technologies.

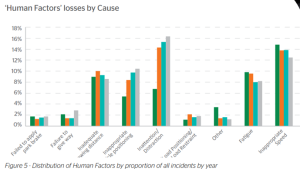

A comprehensive review of nearly two decades’ worth of truck accident data by NTI, one of the nation’s leading transport insurance companies, shows an improvement in safety performance within the trucking industry. However, there is still work to be done, with ‘human factor’ crashes now representing nearly two out of every three serious crashes (64%), after an increase of one percentage point over prior years.

Inattention/distraction (16.3%) tops the list, followed by inappropriate speed (12.5%), inappropriate vehicle positioning (10.5%), inadequate following distance (8.6%), and fatigue (8.2%) (National Truck Accident Research Centre, 2022).

To help address the driver shortage, the industry faces the challenge of training new-to-the-industry employees to the required skill levels, requiring ongoing commitment, innovation, and investment.

The long-standing problem of rest area shortages is another pressing matter. In the 2022 October Budget, the Government committed a welcome additional $80 million to support new and upgraded heavy vehicle rest areas. The road transport industry and drivers have a voice in the design of the initiative to address where they think there are gaps in the rest area network.

Insurance & Accidents

There is a clear link between the prevalence of accidents and the experience level of the operator and drivers. In general, the more experience, the lower the accident frequency. This also has a direct impact on business operating costs and sustainability. Well-trained, skilled drivers keep vehicles on the road, with less downtown due to repairs. For an operator, insurance is a significant expense, but it is also a vital risk transfer solution. For operators, one way to minimise insurance costs is to limit claims, which again links back to driver training and further establishing a culture of safety.

Improving Mental Health & Wellbeing

Making headway on the mental health and wellbeing of the workforce is crucial in attracting and retaining drivers. The transport, postal and warehousing industry is currently ranked 19 out of for workplace mental health and wellbeing (SuperFriend 2021). One organisation tackling this is the Healthy Heads in Trucks and Sheds Foundation, which has an application that helps promote a psychologically safe, healthy, and thriving working environment.

Environmental Concerns

The rise of zero emission vehicles is one of the biggest issues for transport. Consumer and business demand, and government pressure for sustainable deliveries will continue to increase. Electric vehicle (EV) uptake is one lever operators can use to address this issue and it can also help operators manage fuel price volatility. To help operators transition in a sustainable way, Honan continues to have discussions with key insurers regarding electric trucks and technologies and the premium affordability for transport operators.

On the Horizon

The transport industry and heavy vehicle drivers are vital for keeping our country running, and whilst the industry grapples with addressing labour shortages, safety, and the transition to EV, there is still significant opportunity.

In late-March co-founder of Nicholson and Page Transport, Graeme Nicholson, told industry publication PowerTorque after 32 years in business, whilst they have decided to scale back their fleet for a gradual transition to retirement, he still believes right now is a great time to be in the transportation industry, and if he was younger, he’d be buying more trucks.

New truck sales volumes in 2023 suggest there is opportunity and demand. Truck Industry Council sales figures for April showed an all-time sales record for the month for Australia’s commercial vehicle market. Up 9.3% over April last year, and 16.1% year-to-date. The heavy-duty truck segment was a key driver of these figures, up 25.0% for the month, and 21.3% year-to-date on what was a record sales year in 2022.

Next Steps

ATIA has specialised in partnering transport companies and truck driver owner operators for more than sixty years. To run a health check on your insurance policy or program, please reach out at any time.

Contact the team on 03 9947 4333